Why do the words Medicaid and Medicare often bring a sense of overwhelm and confusion? These health coverage programs, while designed to ensure medical security, can seem like a labyrinth of rules and options.

In this article, we’re shedding light on these two pillars of American healthcare. Here, you’ll find straightforward explanations about what each program covers, who qualifies, and how they differ. Read on as we demystify these programs and discover how the right knowledge can empower you to make informed decisions about your healthcare.

Medicaid Explained: Benefits, Eligibility & How to Apply

Medicaid offers medical insurance to millions and particularly benefits those with lower incomes. As of 2023, Medicaid’s reach is vast. The program experienced significant enrollment growth, particularly among low-income adults under age 65 and children.

Data for 2022 shows that total Medicaid enrollment grew to 92.3 million, an increase of 21.2 million from enrollment in February 2020. This surge, influenced by factors like the Affordable Care Act (ACA) and state-specific expansions, illustrates Medicaid’s evolving landscape.

For instance, nearly two-thirds of this increase is attributed to low-income adults, including both adults within the ACA Medicaid expansion group and others like low-income parents not qualifying based on disability.

Income eligibility for Medicaid is a pivotal factor. In 2023, the federal poverty level was set at $14,580 for a single adult, with varying rates for larger households. States like California adopt higher thresholds to reflect local living costs.

For instance, in California, the income limit for a single adult was $20,121 a year. It’s important to note that earning above these thresholds doesn’t outright disqualify individuals from Medicaid. Some higher-income earners may still qualify for less comprehensive benefits, with a sliding scale of Medicaid coverage based on income.

Medicaid’s coverage is substantial and offers both mandatory and optional benefits. Mandatory benefits include essential healthcare services like:

- Physician services

- Preventive measures

- Inpatient and outpatient care

Optional benefits vary by state but can encompass services like prescription drugs, physical therapy, and dental services.

Medicare Explained

Shifting focus to Medicare, this federal program primarily serves individuals over 65. It offers various parts that cover different aspects of healthcare.

Medicare is divided into Parts A, B, C, and D, each catering to specific needs. Part A covers hospital insurance, including inpatient hospital stays, nursing facility care, and home healthcare. Part B, on the other hand, covers outpatient care, including doctor visits and preventive services.

Medicare Part C, also known as Medicare Advantage, is an alternative to the original Medicare plan. It bundles Parts A and B and often includes Part D (prescription drug coverage) to provide a more comprehensive package. Part D of Medicare focuses solely on prescription drug coverage to help reduce the costs of medications.

Medicare eligibility is generally based on age, with 65 being the typical threshold. However, individuals with certain disabilities or conditions, like End-Stage Renal Disease, can also qualify.

While Medicare provides a broad range of coverage, it does not cover everything. For instance, long-term care is not typically covered under Medicare.

Medicaid vs Medicare

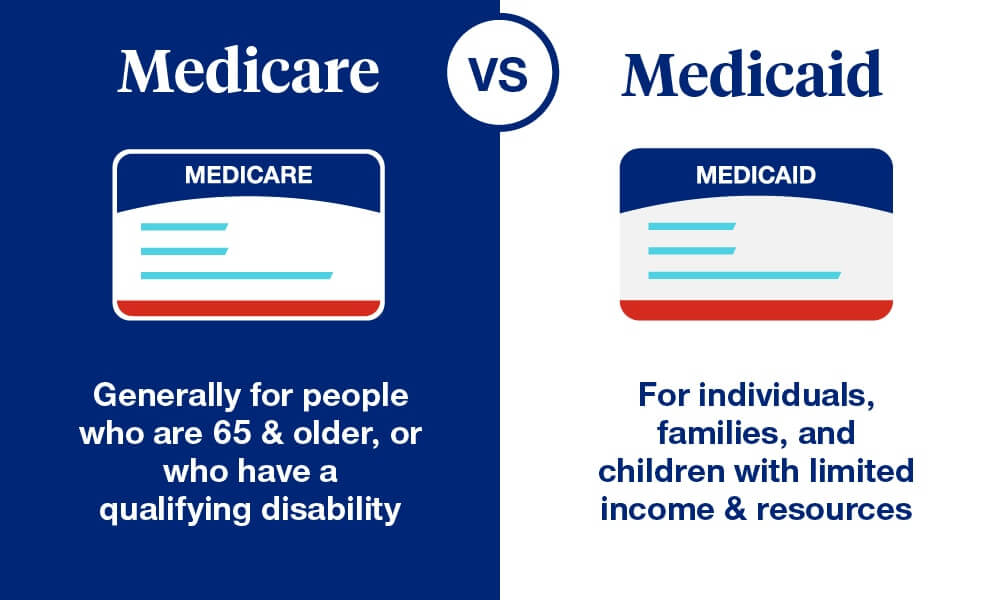

While both Medicaid and Medicare are government-provided health insurance programs in the United States, they cater to different groups and offer varying benefits.

Medicare primarily serves Americans over the age of 65 or younger individuals with specific disabilities or illnesses, such as ALS or end-stage renal disease. Unlike Medicaid, Medicare’s eligibility is not influenced by income levels. It comprises different parts:

- Original Medicare (Parts A and B)

- Medicare Part D for prescription drug coverage

- Medicare Advantage (Part C)

On the other hand, Medicaid targets low-income individuals and families. Eligibility is largely determined by income. This is typically around 138% of the federal poverty line in states with expanded Medicaid.

Medicaid often provides broader coverage compared to Medicare, including:

- Essential healthcare services

- Prescription drugs

- Long-term care

- Vision and adult dental care (in some cases)

It’s also possible for individuals to be eligible for both Medicare and Medicaid, a situation known as being “dual eligible.” Here, Medicare usually pays first for services covered by it, while Medicaid assists with additional costs like deductibles and copayments.

How to Apply and Get the Most Out of Medicaid and Medicare

Applying for Medicare and Medicaid involves different processes, each tailored to the specific program’s requirements. For Medicare, most individuals are automatically enrolled in Parts A and B upon reaching 65, especially if they are receiving Social Security benefits. To enhance coverage, one can add Medicare Part D or enroll in a Medicare Advantage plan that includes drug coverage.

For Medicaid, the application process varies by state but generally involves applying through the state’s Medicaid program or healthcare exchange. Criteria for eligibility differ across states and are based on factors like income and family size.

To maximize the benefits of these programs, it’s important to consider additional coverage options. For Medicare, adding Part D or enrolling in a Medicare Advantage plan can provide more comprehensive coverage, including prescription drugs and sometimes vision and dental care.

Medicaid beneficiaries can access a wide range of services, and in some states, they might receive additional services like non-emergency transportation and durable medical equipment.

Role of Optimized Health Plans

As an independent health insurance agent, we provide an unbiased comparison of all available plans. Optimized Health Plans ensure the most suitable medical insurance policy for individual needs.

We offer expert guidance in understanding the different types of insurance and their benefits, tailoring solutions to individual and family needs. Bystreamlining the application process and assisting in maximizing benefits, we ensure peace of mind and optimal coverage for our clients.

Secure Your Future with the Right Coverage

Choosing the right health insurance can be a game-changer for your well-being and wallet. At Optimized Health Plans, we understand the stakes. That’s why we’re committed to helping you navigate the intricate landscape of Medicaid and Medicare to ensure you find a plan that fits just right.

Understanding your medical insurance options is the first step toward securing your health and financial future. Don’t let complexity hold you back. Reach out to Optimized Health Plans today for a free consultation and embark on a journey to optimal health coverage tailored just for you.